Ecobank exits Mozambique to focus on high-growth markets

Pan-African banking entity Ecobank has announced its decision to exit Mozambique, which is part of its larger initiative to optimize operations and focus on more lucrative markets.In a regulatory announcement to the Nigerian Stock Exchange dated August 5, Ecobank revealed that it has sold all of its shares in its Mozambican subsidiary to FDH Bank of Malawi.

The agreement covers all assets as well as four bank branches, and it has already obtained the necessary regulatory approvals. The completion of the transaction is anticipated by the end of 2025.

The bank stated that no significant disruptions are expected for its customers or employees during the transition period.

Operating in 33 African nations, Ecobank characterized this decision as a strategic move to allocate resources to markets where it can realize greater returns. The operation in Mozambique was deemed small and had minimal influence on the overall performance of the group.

"This decision is consistent with our refined focus on core markets with substantial growth opportunities," the bank affirmed in a statement.

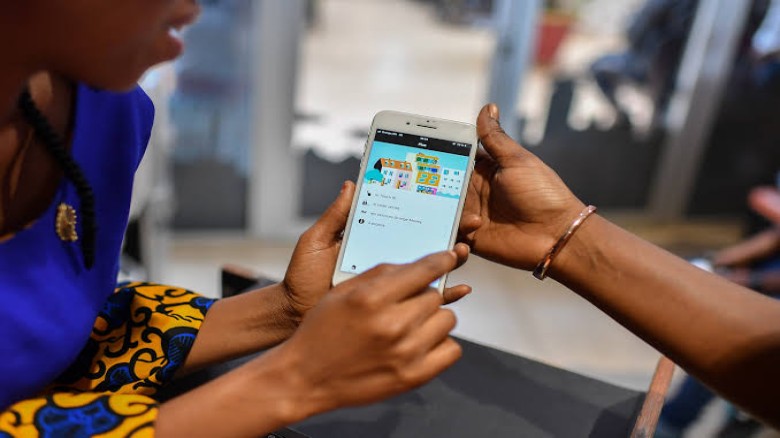

While reducing its physical presence in Mozambique, Ecobank highlighted its commitment to preserving a pan-African presence. In less significant or lower-yield markets, the bank will increasingly depend on strategic alliances and digital platforms to continue serving clients. In this instance, FDH Bank will take over local operations, while Ecobank’s digital services will remain available to users in Mozambique.

This strategic move also coincides with shifts among Ecobank’s major shareholders. Nedbank, the largest external investor in the bank from South Africa, recently declared its intention to divest its 21.2% stake in the group—reflecting a broader trend among African financial institutions towards more streamlined and focused regional approaches.

Rather than retreating from the continent entirely, Ecobank’s recent actions suggest a recalibration—focusing on consolidating in fewer, more favorable markets while utilizing technology and partnerships to maintain a robust regional presence.

In a banking landscape that is increasingly competitive and sensitive to costs, the bank seems to be choosing its battles wisely—emphasizing profitability over sheer presence.

Leave A Comment